Expert Criminal Defence & Traffic Offence Lawyers

Expert Criminal Defence & Traffic Offence Lawyers in Geelong and Beyond

Chase Murphy Lawyers is your trusted legal partner, specialising in Criminal Law, Youth Crime, Child Protection, Intervention Orders, and Crime Commission Inquiries. Committed to preserving our clients rights and delivering justice with resilience, we offer expert advice and representation. Our holistic approach recognises the intersection of legal issues with other aspects of our clients lives. Thus, we provide comprehensive support and work closely with clients to achieve optimal outcomes.

At Chase Murphy Lawyers, we prioritise effective communication and personalised attention. We build strong relationships with our clients, ensuring they are fully informed and supported throughout their legal journey. With us, you can trust that your legal matters are in capable hands.

Ready to take the first step toward resolving your legal concerns? Contact us today to schedule a consultation. Chase Murphy Lawyers is here to provide the guidance and representation you need.

We service Melbourne, Geelong, Surfcoast and Regional Victoria

When it comes to criminal law, getting the right advice can make all the difference. Our team of experienced lawyers are here to help minimise the impact on your life, livelihood, and family. We offer personalised advice, strong representation, and a commitment to achieving the best possible outcomes to protect your future and secure your peace of mind.

Looking for legal advice and representation in the Children’s Court? Our team specialises in both criminal and family divisions. Let us guide you through the process and protect your young persons rights.

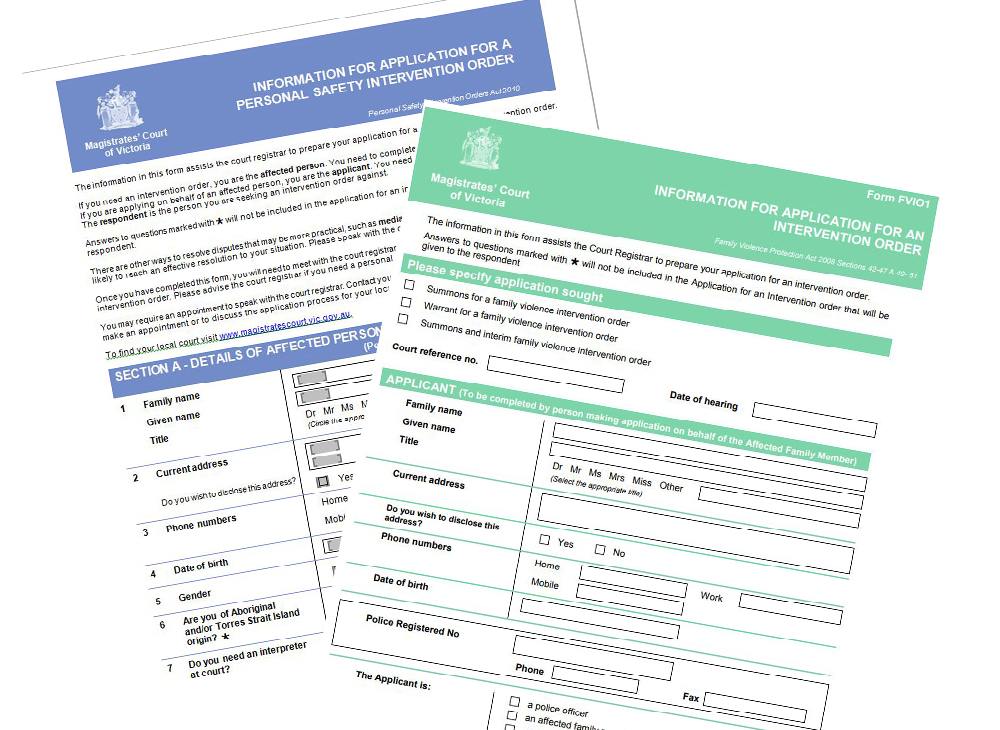

Intervention orders are powerful court orders designed to safeguard individuals and families from violence and ensure their safety. Our experienced family violence lawyers can help you navigate the legal process and provide the support you need.

Our lawyers are experienced in acting and appearing for witnesses and persons the subject of investigation by the ACC. Should you require representation in relation to any aspect of the ACC’s operations, contact us for legal assistance.